Does A Business Insurance Cover Your Office Rental?

Does A Business Insurance Cover Your Office Rental?

The modern workplace is changing, and more and more businesses are opting to rent office space instead of owning it. Many entrepreneurs and business owners are asking the same question - Does business insurance cover my office rental?

The answer to this question depends on the type of coverage you have. In this blog post, well explore the different types of business insurance and how they can help protect your office rental. So, lets get started!

Understanding A Business Insurance

Business insurance is a type of insurance that protects businesses from financial losses due to unforeseen circumstances. It can cover a variety of different risks, from property damage to legal fees. Business insurance can help protect businesses from unexpected costs and ensure that they are able to stay afloat in the event of a disaster.

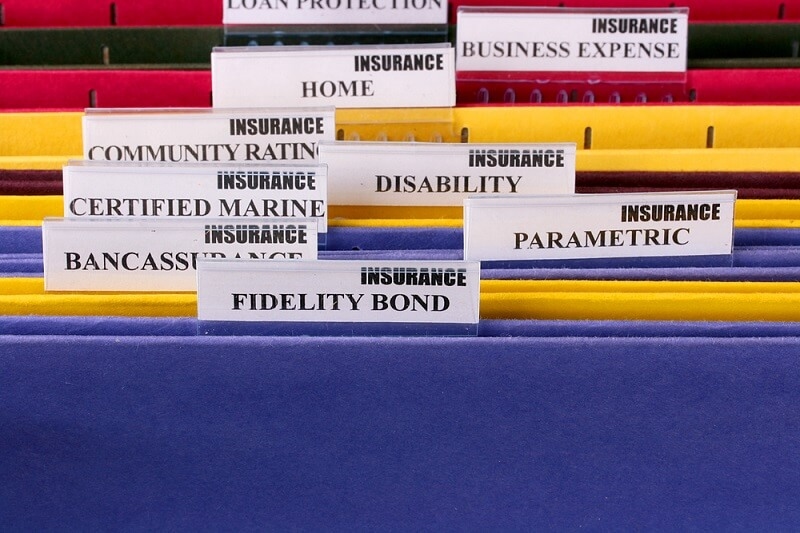

There are several types of business insurance, including general liability, property insurance, workers compensation, and business interruption insurance. Each type of business insurance offers different levels of protection for businesses and can help cover the costs of various risks.

Business Insurance Protects Office Rental

Business insurance can help protect your office rental in a variety of ways. General liability insurance can help cover the costs of any legal fees associated with an office rental. Property insurance can help cover the costs of any damage to the property, such as fire or flood damage.

Workers compensation insurance can provide financial protection for any injuries that occur on the premises of the office rental. Finally, business interruption insurance can help cover the costs of any lost income due to a disaster or other event that disrupts business operations.

Type of Business Insurance Available

The sort of business insurance you require will be determined by the type of business you own and the risks involved. For example, if you run a retail store, you may require general liability insurance to protect yourself from consumer lawsuits. However, if you run a restaurant, you may require property insurance to cover the expenses of any structure damage.

It is critical to consult with an insurance consultant to establish the sort of commercial insurance you require for your office leasing. An expert insurance agent can advise you on the types of coverage you should consider and assist you in finding the ideal policy for your company.

Business Insurance Does Not Cover Everything

Its important to keep in mind that business insurance does not cover everything. For example, business insurance will not cover any losses due to intentional acts, such as theft or vandalism. Additionally, business insurance does not cover any losses due to negligence or improper maintenance.

Exploring Office Rent Insurance

Office rent insurance is a sort of commercial insurance that expressly covers the costs of office renting. This sort of insurance can assist in covering the expenses of any damage or losses incurred as a result of an unforeseen incident, such as a fire or flood. It may also cover the price of any legal fees linked with the renting of an office space.

Office rent insurance is often sold as a supplement to a standard company insurance policy. It is critical to consult with an insurance professional to evaluate whether office rent insurance is the best solution for your company.

Coverage Of Office Rent Insurance

Office rent insurance can help cover the costs of any damage or losses due to an unexpected event while renting an office. This type of insurance can also help cover the costs of any legal fees associated with an office rental.

Office rent insurance can also help cover the costs of any repairs that need to be made due to damage or wear and tear. Additionally, office rent insurance can help cover the costs of any lost income due to a disaster or other event that disrupts business operations.

Cost of Office Rent Insurance Varies

The cost of office rent insurance will vary depending on the type of coverage you need. Generally, office rent insurance is relatively inexpensive. However, the cost of the coverage can vary based on the amount of coverage you need and the type of business you own.

Its important to talk to an insurance agent to determine the cost of office rent insurance for your business. An experienced insurance agent can provide valuable advice about the types of coverage you should consider and help you find the best policy for your business.

Learning About Office Renters Liability Insurance

Office renters liability insurance is a sort of commercial insurance that is specially designed to cover the costs of any legal bills linked with the leasing of office space. This insurance might assist in covering the expenses of any litigation made against you as a result of an incident that occurred in your office rental.

Office tenants' liability insurance is often sold as a supplement to a standard company insurance policy. It is critical to consult with an insurance professional to establish whether office tenants' liability insurance is the best option for your company.

Coverage of Office Renters Liability Insurance

Any legal bills connected with renting an office may be covered by office renters liability insurance. This kind of insurance can also aid in defraying the expense of any losses or damages brought on by an incident that took place in the rented office space.

The expense of any repairs that are necessary as a result of damage or normal wear and tear may also be covered by office renters liability insurance. Additionally, office renters liability insurance may assist in paying for any lost revenue brought on by a catastrophe or other occurrence that interferes with business operations.

Cost of Office Renters Liability Insurance

Depending on the kind of protection you want, the price of an office renter's liability insurance will change. Office tenants' liability insurance is often affordable. The quantity of coverage you require and the kind of business you run, however, might affect the cost of the insurance.

To find out how much office rent insurance may cost your company, it's vital to speak with an insurance representative. A knowledgeable insurance agent can help you discover the ideal policy for your company and offer important guidance on the sorts of coverage you should think about.

Conclusion

In conclusion, whether business insurance covers your office rental depends on the specific policy you have in place. It is crucial to carefully review your insurance policy and consult with your insurance provider to understand the extent of coverage it offers. While some policies may include coverage for rented office spaces, others may not. To adequately protect your business, it is advisable to consider obtaining a comprehensive insurance policy that specifically addresses your office rental needs.

This content was created by AI